What is a financial controller?

A financial controller is someone who oversees all accounting activities within a company. In the simplest of definitions, they are the lead accountant. Their role is to provide financial leadership and ensure accounting allocations are made and recorded. Typically, a financial controller will report to the chief financial officer (CFO); however, in smaller companies these roles may be combined [1].

Responsibilities:

The exact duties and responsibilities of a financial controller vary due to factors such as the magnitude of your company, the size of its accounting department, and the complexity of accounting operations employed within your company [2].

A controller has many responsibilities which include, but not limited to:

- Preparing budgets and maintaining budget schedules

- Collecting and analyzing financial data

- Inspecting budget variances, summarizing trends, and investigates deficiencies

- Oversees all accounting transactions

- Assisting with internal and external audits

- Filing company financial reports and tax preparation [1]

Most importantly, we can help you to find and develop talented people, improve reporting methods and add value to business, and improve efficiency.

In smaller companies, a controller is often expected to be more versatile in their functions. They may take on additional cash management responsibilities such as overseeing accounts payable & receivable, cash disbursements, payroll, and bank reconciliations. Additionally, they may perform managerial duties such as recruitment, selection, and training of staff within the accounting department.

In larger organizations, such as government and nonprofits, there will be another similar position called a comptroller which is a more senior-level management position than controller but performs the same duties and reports to the CFO or CEO [1].

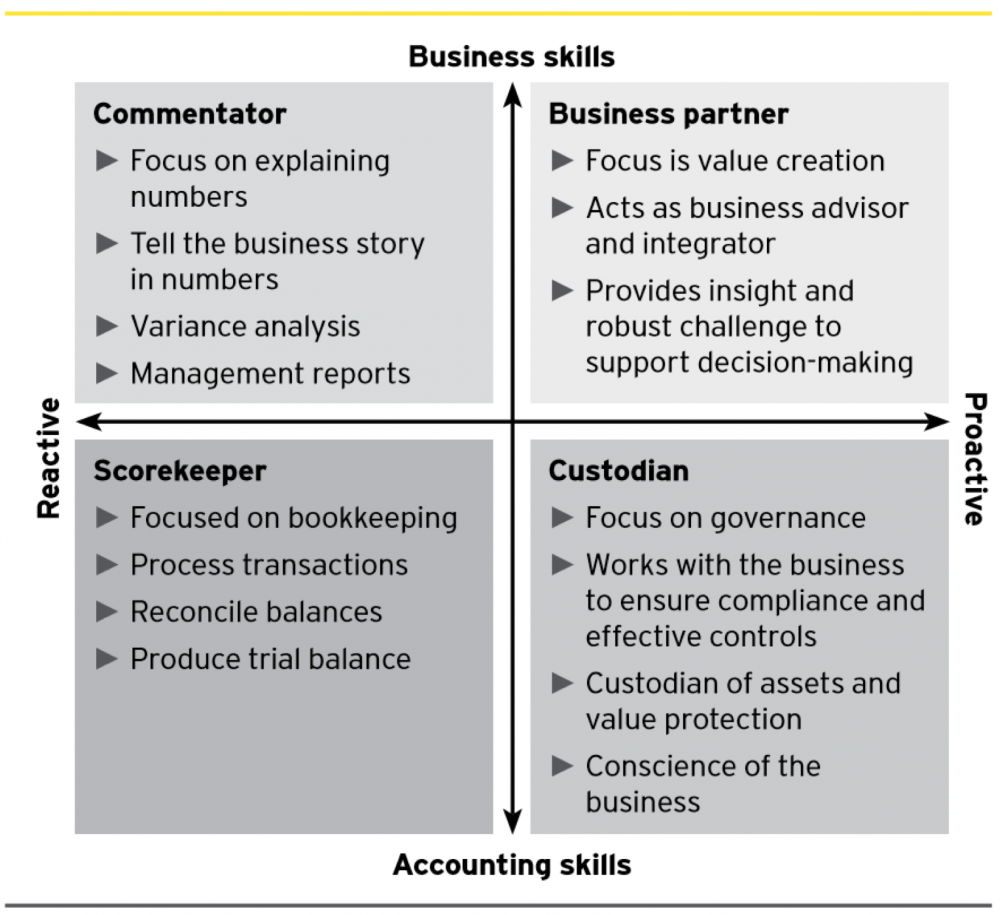

Ernst & Young’s – Roles in the Finance Function [2]

How hiring Cody & James as a controller can help grow your company [4]:

- Take responsibility for your company’s finances. As your controller, we will have an in-depth understanding of your finances and will be able to optimize and strategize them. We will be able to make major financial and legal decisions from purchasing new assets to handling business insurance. This will help to free up your time allowing you to focus on growing and developing your company.

- Save your business money. As a qualified controller, we will be able to identify areas of concern and initiate cost-saving measures.

- Negotiate for you and become a valued business partner. Another way we can save you money as your financial controller is by negotiating the absolute best terms with your suppliers. Controllers should also have the confidence to give you their honest opinion in regard to your business decisions and spending habits.

- Manage your data. We supervise your financial data entry and ensure its efficiency and accuracy and have the knowledge of accounting technologies that can help to streamline your business’ accounting department.

Do I need a controller?

If you’ve got this far in and are still asking this question, the chances are yes.

There are many benefits to hiring us as a controller. Here are some major situations that would put you in the position to benefit the most from this service [3]:

Expanding your business

If you’re opening new business locations or conducting new lines of business, you could benefit from hiring a controller. A controller will be able to advise you on how to invest your capital wisely and save you money in the process.

You need someone more than just your accountant

You love your accountant but wish they were able to oversee your entire accounting department, hire highly skilled staff and find ways to streamline your financial department. This is the expertise of a controller.

Your CFO is overwhelmed

If your CFO is struggling to supervise the accounting department and still create excellent financial reports, hiring a controller would be of great help. A controller can take over the supervision role and report directly to the CFO with information they need to report on.

Get Started

At Cody & James, we’re ready when you are. If you think you could benefit from our controller service, get in touch today to set up an appointment. We look forward to working with you.

Still have questions?

If you’re still unsure if a controller is a necessary call or the right choice for you, call us. We provide business consulting services designed to help you take the next step with your business.

Sources:

[1] Grant, Mitchell. “Controller.” Investopedia, Dotdash, 27 September 2020, https://www.investopedia.com/terms/c/controller.asp. Accessed 18 March 2021.

[2] Ernst & Young. “The Changing Role of the Financial Controller.” The Sunflower Group, 2017, https://thesunflowergroup.co.uk/wp-content/uploads/2017/07/EY_Financial_controller_changing_role.pdf. Accessed 18 March 2021.

[3] Signature Analytics. “What Does a Controller Do and Should You Hire One?” Signature Analytics, Signature Analytics, 2020, https://signatureanalytics.com/blog/what-does-a-controller-do-and-should-you-hire-one/. Accessed 18 March 2021.

[4] Signature Analytics. “How a Controller Can Grow Your Business.” Signature Analytics, 2020, https://signatureanalytics.com/blog/how-a-controller-can-grow-your-business/. Accessed 18 March 2021.