An employee who makes tips (aka gratuities) as part of their income is obligated to declare that income on their personal tax return.

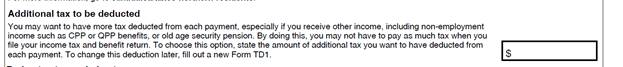

This often does mean that a person will owe tax, as opposed to getting a refund. To reduce this potential balance owing, employees who make tips can ask for additional tax to be taken off their pay by checking off the Additional tax to be deducted request box, on page two of the federal TD1 forms:

The amount to ask for is entirely subjective, however a good starting point is $20 per pay - this adds up to $520/ year in deductions for a biweekly pay earner, which could end up greatly reducing possible tax owing at the end of the year. Basically, paying more tax over the year can save on tax owing at year end.

The amount to ask for is entirely subjective, however a good starting point is $20 per pay - this adds up to $520/ year in deductions for a biweekly pay earner, which could end up greatly reducing possible tax owing at the end of the year. Basically, paying more tax over the year can save on tax owing at year end.